Certified Financial Planner Course (CFP)

About Certified Financial Planner (CFP) Course and Certification

Certified Financial Planner (CFP) is a leading Certification globally recognized in the field of Financial Planning with over 213,000 CFP professionals. It is popular in more than 27 territories across the world. It is a professional mark for financial planners granted by the Financial Planning Standards Board (FPSB).

CFP credential stands out as the foremost global certification, coveted by those aspiring to demonstrate their unwavering dedication to the practice of competent and ethical financial planning.

CFP certification is recognized worldwide as a symbol of excellence and the Gold standard certification for financial planning.

Why CFP Course?

Recognized Globally

Recognized Globally

Rated as the

Rated as the Gold Standard

in Financial Planning by the Wall Street Journal

Rated as “One of the Best Job” by U.S. News and World Report

Rated as “One of the Best Job” by U.S. News and World Report

Valid in more than 27 territories across the world

Valid in more than 27 territories across the world

Unique 4-in-1 Program - 1 program, 4 global personal finance certifications

Unique 4-in-1 Program - 1 program, 4 global personal finance certifications

65% global pass rate

65% global pass rate

Average salary package 5 – 15 lakhs p.a.

Average salary package 5 – 15 lakhs p.a.

CFP Course Subjects

Client Financial Situation

Client Financial Situation

Time Value of Money

Time Value of Money

Cash Flow Demands and Conflicts

Cash Flow Demands and Conflicts

Budget and Emergency Fund

Budget and Emergency Fund

Debt and Financing Alternatives

Debt and Financing Alternatives

Financial Management Strategies

Financial Management Strategies

Asset Classes and Securities

Asset Classes and Securities

Pooled Investment Products

Pooled Investment Products

Principles of Investment Risk

Principles of Investment Risk

Investment Performance Management

Investment Performance Management

Investment Theory

Investment Theory

Asset Allocation

Asset Allocation

Wealth Management

Wealth Management

Behavioral Finance

Behavioral Finance

Objectives, Constraints and Suitability

Objectives, Constraints and Suitability

Client Best Interest

Client Best Interest

Economic Environment

Economic Environment

Social and Political Environments

Social and Political Environments

Compliance and Implications

Compliance and Implications

Anti-Money Laundering

Anti-Money Laundering

Retirement Principles

Retirement Principles

Retirement Objectives

Retirement Objectives

Retirement Needs, Analysis, and Projections

Retirement Needs, Analysis, and Projections

Sources of Retirement Cash Flow

Sources of Retirement Cash Flow

Retirement Cash Flow, Withdrawal Projections and Strategies

Retirement Cash Flow, Withdrawal Projections and Strategies

International Taxation

International Taxation

Cross Border and Source Rules

Cross Border and Source Rules

Tax Strategies

Tax Strategies

Accounting Standards and Research

Accounting Standards and Research

Principles

Principles

Risk Exposures

Risk Exposures

Intro to Insurance

Intro to Insurance

Insurance Company/Advisor Selection

Insurance Company/Advisor Selection

Strategic Solution

Strategic Solution

Estate Planning Terminology

Estate Planning Terminology

Wealth Distribution Goals

Wealth Distribution Goals

Estate Planning Process

Estate Planning Process

Transfer During Life and at Death

Transfer During Life and at Death

Planning for Incapacity

Planning for Incapacity

Estate Planning Strategies

Estate Planning Strategies

Financial Planning Process

Financial Planning Process

Practice Standards

Practice Standards

Professional Skills

Professional Skills

Client Characteristics

Client Characteristics

Client Engagement and Communication

Client Engagement and Communication

Critical Thinking

Critical Thinking

Introduction to the Discovery Process

Introduction to the Discovery Process

Appreciative Inquiry

Appreciative Inquiry

Discovery Process Applied

Discovery Process Applied

Goal Determination, Refinement and Setting

Goal Determination, Refinement and Setting

Develop Financial Planning Recommendations

Develop Financial Planning Recommendations

Presenting Recommendations to Clients

Presenting Recommendations to Clients

Financial Planning Overview

Financial Planning Overview

Financial Plan Elements

Financial Plan Elements

Developing Effective Plans

Developing Effective Plans

Sample Financial Plans

Sample Financial Plans

Financial Plan Assessment

Financial Plan Assessment

CFP Course Eligibility, Duration and Exemptions

Eligibility

Pathways of CFP Certification and Eligibility Criteria

The CFP certification offers two distinct pathways based on the candidate's eligibility and prior academic qualifications.

-

Regular Pathway

Regular Pathway

-

Fast Track Pathway

Fast Track Pathway

Regular Pathway

Candidates must have completed their 12th grade with a minimum of 50% marks from a recognized board.

Candidates must have completed their 12th grade with a minimum of 50% marks from a recognized board. Those Opting for the Regular pathway are required to pass 3 specialist exams ( Investment Planning Specialist; Retirement and Tax Planning; Risk and Estate Planning ). Once candidates have obtained all 3 Specialist Certifications, they can enroll in the Integrated Financial Planning Certification. After the evaluation of their submitted financial plan, candidates become eligible to take the final CFP exam.

Those Opting for the Regular pathway are required to pass 3 specialist exams ( Investment Planning Specialist; Retirement and Tax Planning; Risk and Estate Planning ). Once candidates have obtained all 3 Specialist Certifications, they can enroll in the Integrated Financial Planning Certification. After the evaluation of their submitted financial plan, candidates become eligible to take the final CFP exam.

Fast Track Pathway

Check EligibilityThose opting for the Fast Track Pathway are directly exempted from the first three specialist exams (Investment Planning Specialist, Retirement and Tax Planning, Risk and Estate Planning) and can begin preparing for the final module.

Eligibility (Education + Experience) of Fast Track Pathway

Education:

Approved Qualifications/Professional Certifications:

-

Chartered Financial Analyst, from CFA Institute (USA)

Chartered Financial Analyst, from CFA Institute (USA)

-

Certified Public Accountant, from AICPA (USA), CMA, ACCA

Certified Public Accountant, from AICPA (USA), CMA, ACCA

-

Chartered Accountant, from ICAI, CA(Inter) with 3-year Articleship+B.Com

Chartered Accountant, from ICAI, CA(Inter) with 3-year Articleship+B.Com

-

Fellow Member of Insurance Institute of India (Life/General)

Fellow Member of Insurance Institute of India (Life/General)

-

Advanced Wealth Management Course, from IIBF, CAIIB+B.Com (any degree)

Advanced Wealth Management Course, from IIBF, CAIIB+B.Com (any degree)

-

Postgraduate degree in Economics, Commerce, Finance/Financial Planning from a UGC approved University.

Postgraduate degree in Economics, Commerce, Finance/Financial Planning from a UGC approved University.

-

MBA or PGDFM from an AICTE-approved Institute

MBA or PGDFM from an AICTE-approved Institute

Experience:

Minimum 3 years of prior work experience at the time of submission of documents will be considered in case of employees of a:

-

Any bank, non-banking Finance Company (NBFC)

Any bank, non-banking Finance Company (NBFC)

-

Mutual Fund Asset Management

Mutual Fund Asset Management

-

Insurance Company

Insurance Company

-

Securities Company

Securities Company

-

Portfolio Manager

Portfolio Manager

-

Brokerage

Brokerage

-

Registered Investment Adviser

Registered Investment Adviser

-

Treasury department of a company registered with the RoC

Treasury department of a company registered with the RoC

-

Academic institution or FPSB’s Authorized Education Provide

Academic institution or FPSB’s Authorized Education Provide

Such experience shall be in one of the following broad job activities:

-

funds management

funds management

-

investment advice

investment advice

-

accounting/fund accounting/auditing

accounting/fund accounting/auditing

-

corporate finance

corporate finance

-

customer relationship/investor service

customer relationship/investor service

-

lecturing in Academic Institutions on Economics/Commerce/Finance or teaching/training on FPSB’s CFP certification curriculum based on Financial Planning Education Framework

lecturing in Academic Institutions on Economics/Commerce/Finance or teaching/training on FPSB’s CFP certification curriculum based on Financial Planning Education Framework

Duration

The Certified Financial Planner (CFP) certification is a professional program offered by the Financial Planning Standards Board (FPSB). It spans from a minimum of 6 months to 2 years in duration and equips individuals with expertise in financial planning.

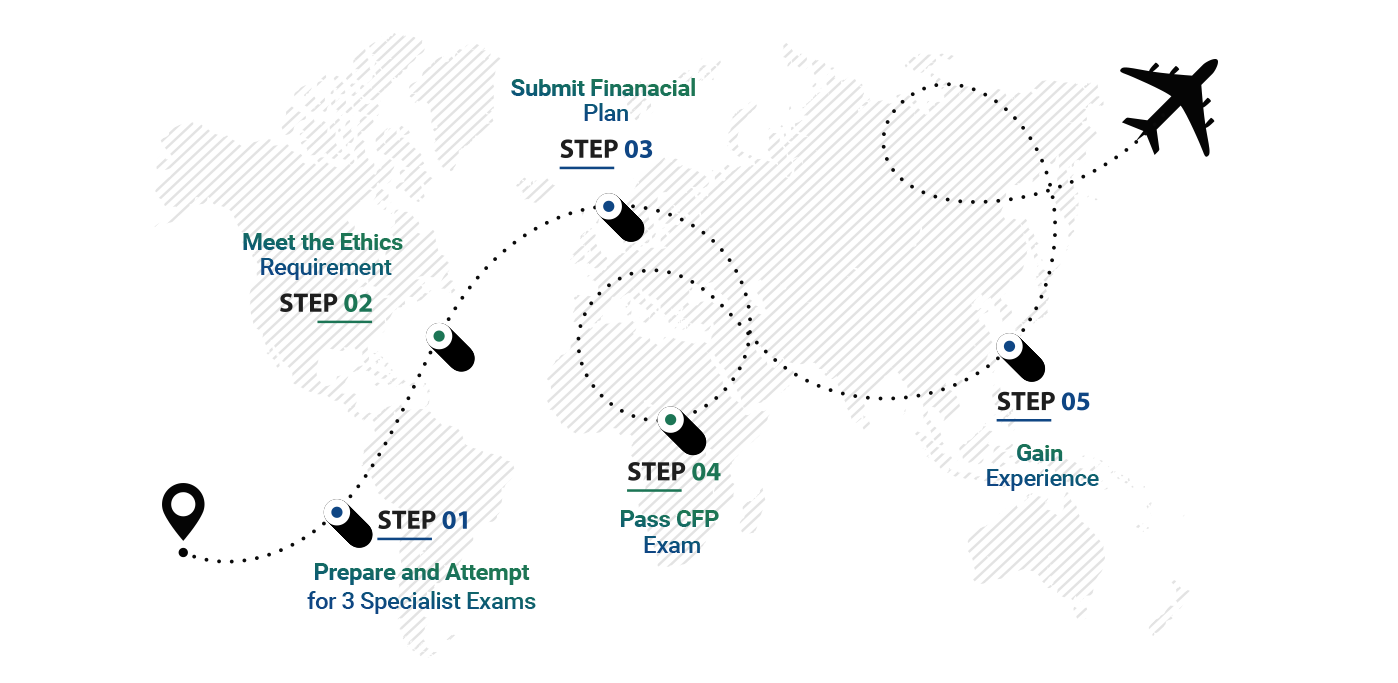

CFP Certification Process

Why 88LEARN

CFP Course Fees in India

| 88Learn LEARNING FEES | ||

|---|---|---|

| CFP Level Wise Fees | Regular | Fast Track (CFP Final) |

| CFP Level 1 | ₹ SGD 243 | |

| CFP Level 2 | ₹ SGD 243 | |

| CFP Level 3 | ₹ SGD 243 | ₹ SGD 565 |

| CFP Final | ₹ SGD 243 | |

| Total | ₹ SGD 972 | ₹ SGD 565 |

| 4 in 1 Combo | ₹ SGD 727 | |

| Loan Option | Pay just SGD 81 Balance - No Cost EMI | Pay just SGD 81 Balance - No Cost EMI |

| FPSB BOARD FEES | |||

|---|---|---|---|

| REGULAR PATHWAY | FAST TRACK (CFP FINAL) | ||

| Registration | SGD 292 | Document verification Fees | SGD 81 |

| E-book Fees | SGD 526 | Registration + E - book Fees | SGD 551 |

| Level 1,2,3 | SGD 105 each | Final CFP | SGD 211 |

| Level 4 | SGD 211 | Project Fee | SGD 170 |

| Exam Fees | SGD 539 | Total Fees | SGD 1,012 |

| Level 1,2,3 | SGD 109 each | ||

| Level 4 | SGD 211 | ||

| Project Fee | SGD 170 | ||

| Certification Fee | SGD 139 | ||

Career Opportunities after CFP Course

Financial Planner

Financial Planner

Financial Advisor

Financial Advisor

Financial Assistant

Financial Assistant

Financial Analyst

Financial Analyst

Portfolio Manager

Portfolio Manager

Investment Manager

Investment Manager

Mutual Fund Admin

Mutual Fund Admin

Tax Consultant

Tax Consultant

Insurance Advisor

Insurance Advisor

Wealth Management

Wealth Management

Private Banking

Private Banking

Meet Our Expert Faculty

Learn From Industry Experts

Placements after CFP course with VGLD

FAQ's

If you're seeking excellent education for Certified Financial Planner (CFP) certificant, choose VGLD. They are the experts, ready to address all your questions. Call us at +91-9700000038 or visit www.vglearningdestination.com

The minimum eligibility criteria for the Regular Pathway is a 12th-grade passing certificate from a recognized board.

Rated as "One of the Best Jobs" by U.S. News and World Report, 2012

Rated as Gold Standard by Wall Street Journal

The most recognized and respected financial planning certification in 27 territories

Supported, recognized, promoted, and preferred by 48 organizations of the BFSI Industry

The starting salary of a certificant Financial Planner ranges from 5 lacs – 15 lacs depending upon the field of work.

Yes, the CFP designation is recognized globally. It signifies a standardized level of competency in financial planning and is respected in many countries, providing opportunities for international career mobility.

The CFP exam covers various topics, including financial planning principles, investment planning, retirement planning, tax planning, estate planning, and more. It assesses the candidate's ability to apply knowledge in real-world financial planning scenarios.

Yes, When a CFP professional wants to practice financial planning using the CFP marks in multiple territories, they must get certified for each territory they intend to practice in If certified in more than one territory, they need to adhere to the renewal requirements of each territory's FPSB affiliate organization and be overseen by them.

6 – 12 Months

The CFP exam is exclusively conducted online. After completing and passing a course, students have the opportunity to register for the certification exam, which is also administered online.

The CFP mark and CFA charter are prestigious designations in their fields, governed by respective bodies. CFP professionals focus on Personal Finance, while CFA charterholders focus on corporate finance.