Association of Chartered Certified Accountants (ACCA)

About ACCA Course

ACCA stands for the Association of Chartered Certified Accountants. It is a UK-based syndicate/group of qualified professional accountants. The ACCA is the largest confederation of accounts professionals with a whopping 228,000+ members and counting alongside an additional half a million students enrolled. The ACCA certification is accepted globally for the high standards and quality of the course that includes a myriad of professionally oriented developmental activities.

Note: Students who have cleared their class 10 examinations, or do not qualify as per the criteria above, can still register for the ACCA Course via the Foundation in Accountancy (FIA) route.

Why ACCA Course?

Handsome salary

packages starting 5-8 lakh Rupees

Handsome salary

packages starting 5-8 lakh Rupees

Recognised in

more than 180+ countries

Recognised in

more than 180+ countries

Quarterly Exams

Quarterly Exams

Pass Percentage

above 50%

Pass Percentage

above 50%

2,41,000 +

Members & 5,42,000 Students

2,41,000 +

Members & 5,42,000 Students

On-demand

Computer Based Exams (CBEs)

On-demand

Computer Based Exams (CBEs)

100% Placement Assistance & Pass Guarantee after completing ACCA Course

ACCA Course Subjects

Applied Knowledge

3 Papers

Business & Technology (BT)

Business & Technology (BT)

Management

Accounting (MA)

Management

Accounting (MA)

Financial

Accounting (FA)

Financial

Accounting (FA)

Applied Skills

6 Papers

Corporate and

Business Law

(LW)

Corporate and

Business Law

(LW)

Performance

Management (PM)

Performance

Management (PM)

Taxation (TX)

Taxation (TX)

Financial Reporting

(FR)

Financial Reporting

(FR)

Audit & Assurance

(AA)

Audit & Assurance

(AA)

Financial

Management (FM)

Financial

Management (FM)

Professional

4 Papers

Strategic Business

Leader

(SBL)

Strategic Business

Leader

(SBL)

Strategic Business

Reporting (SBR)

Strategic Business

Reporting (SBR)

Advanced Financial

Management (AFM)

Advanced Financial

Management (AFM)

Advanced

Performance

Management (APM)

Advanced

Performance

Management (APM)

Advanced Taxation

(ATX)

Advanced Taxation

(ATX)

Advanced Audit &

Assurance

(AAA)

Advanced Audit &

Assurance

(AAA)

ACCA Eligibility

10th Grade : Foundation in

Accountancy (FIA) route

10th Grade : Foundation in

Accountancy (FIA) route

12th Grade : ACCA route

12th Grade : ACCA route

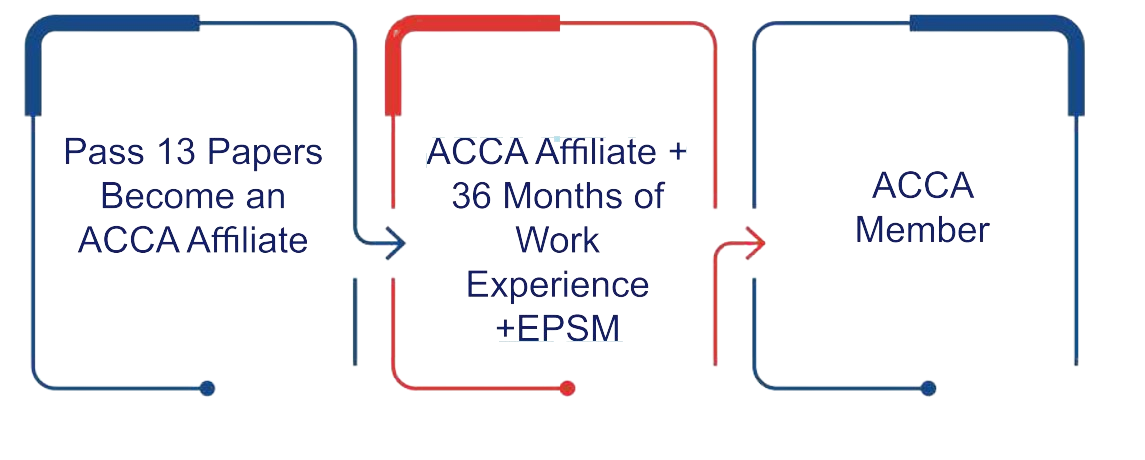

ACCA Course Certification Process

Why 88LEARN

Scholarship For 88Learn Students after ACCA Course

No Exemption

SGD 159

Avail ACCA Registration + Classes for BT,MA,FA & LW

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Exemptions

SGD 698

NOTE: (Paper F1-F4) GBP 15 per exemption needs to be paid to ACCA to claim these exemptions. Also, 50% of Annual subscription for calendar year 2024 to be paid by student.

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Annual Subscription Fees: GBP 134 for 2023 and 50% waiver off Annual Subscription for calendar year 2024 for B.Com (H), IPCC & ICAI members only

Exemption Fees: Knowledge Level Papers – GBP 84 each Skills Level Papers – GBP 123 each

5 Exemptions

Avail up to 9 Exemptions

NOTE : (Paper BT, MA, FA, TX &

AA)

GBP 15

per exemption needs to be paid to ACCA to claim these exemptions and Additional

exemptions claimed on the basis of B.com (H) and 40+ marks in CA Final level

exam of

Costing, SFM, FR shall be 100% PAID exemptions by the student.

Exemption Fee = Exam Fee. Also, 50% of Annual subscription for calendar year

2024 to

be

paid by the student

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Annual Subscription Fees: GBP 116 for 2023 and 50% waiver off Annual Subscription for calendar year 2024 for B.Com (H), IPCC & ICAI members only

Exemption Fees: Knowledge Level Papers – GBP 84 each Skills Level Papers – GBP 123 each

9 Exemptions

SGD 1,418

SGD 910

NOTE: (BT, MA, FA, LW, PM, TX, FR, AA & FM) GBP 15 per exemption needs to be paid to ACCA to claim these exemptions. Also, 50% of Annual subscription for calendar year 2024 be paid by the student.

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Annual Subscription Fees: GBP 134 for 2023 and 50% waiver off Annual Subscription for calendar year 2024 for B.Com (H), IPCC & ICAI members only

Exemption Fees: Knowledge Level Papers – GBP 84 each Skills Level Papers – GBP 123 each

Meet Our Expert Faculty

Learn From Industry Experts

Placements after ACCA course with 88Learn

Blogs

FAQ's

-ACCA stands for Association of Chartered Accountants

-It is a UK-based syndicate/group of qualified professional accountants which is over 100 years old

-It is globally recognised accounting qualification

-ACCA is recognised in 170+ countries including UK,UAE,Singapore and many more.

-ACCA jobs are available across the globe !

-To check, choose your desired country from the link below:

https://jobs.accaglobal.com/?utm_source=ACCAglobal&utm_medium=referral&utm_campaign=navbar1- A Qualified CA gets exemptions of up to 9 papers just leaving 4 papers to appear for. VG Learning Destination provides scholarships of up to SGD 1,418 for Qualified CAs.

- A CA IPCC student may get UPTO 9 exemptions ( 5 on the basis on IPCC+ others)!

VG Learning Destination provides Scholarship upto SGD 910 for CA IPCC students

- A B.Com graduate from a recognised university may get up to 4 exemptions.

- VG Learning Destination offers Scholarship upto SGD 698 for B.Com graduates.

-There are a total of 13 papers are there in ACCA, spread across 3 levels

-No there is no aggregation/grouping in ACCA. Students need to score 50% in each paper to pass.

-No, ACCA is completely flexible. Candidates can appear for any paper within the level in any sequence.

-ACCA exams are held 4 times a year

-The 1st four exams are ON –Demand and can be given at any time without waiting for the quarter.

- Completing 3 E’s of ACCA, namely Exams, EPSM and Experience makes you an ACCA member

A candidate must have 36 months of training in ACCA

-Yes, CA Articleship is recognised as ACCA PER

The salary ranges from SGD 6500 to SGD 23000 depending upon the candidates skills and companies demand. Fresh Graduates earn around SGD 6500(which is same for a CA) while the average salary is around SGD 13000. There will be an increase in average salary in future as the demand for ACCA qualified candidates is on a steady rise.

-Yes, Scholarship upto SGD 1,425 is available from 88Learn

-Exemptions and Scholarships depend upon the your entry level Qualification in ACCA.

-Yes, students can start their ACCA journey right after their 10+2 examination.

-Yes, students from Class 11 & 12 Commerce can start with their ACCA journey with VG Learning Destination. They can avail of annual subscriptions, waiver benefits for 2 years and free ACCA registration.

-ACCA classes from 88Learn are LIVE Online classes over the weekends with 100% back up

-EY,PWC,Deloitte,Grant Thornton,BDO,Citibank,Protivity,Accenture,S and Martin and Amazon

-Accounting, Finance, Audit & Assurance, Taxation, Insolvency,Forensic Accounting and many more…

| Parameters | CA | ACCA |

|---|---|---|

| Recognised | Only in India | Recognised in 180 countries |

| Flexibility | No Flexibility, Need to give in predefined groups | Complete Flexibility, can choose any paper within the level |

| No of papers | Need to attempt all papers in the group | Complete Flexibility- can choose a minimum of 1 paper in the level |

| Exam | Fixed tenure of CPT(4 papers in a day!!!) | Complete flexibility to choose first 4 exams as per own convenience |

| Frequency of Exams | Twice a year | Four times a year |

| Pass Rate | 40% Individual, 50% Aggregate Overall Passrate – 20% | Flat 50% in all , No Aggregation Overall Passrate – 60% |

| Training | 2 ½ Years training compulsory before you can attempt final level | No such requirement. Can do training at any time-Before, During, After completion( includes CA Articleship) |

| MBA | ACCA |

|---|---|

| Too many MBA’s graduating every year with lack of Employable Skill Set | ACCA, on the other hand, has a hands-on approach where the students can deal with high level of practical content rather than just theoretical concept. This approach paves the way for students to master various interpersonal skills. |

| Focusing on irrelevant subjects like Marketing ,IT etc is a waste of time and effort on the part of students | On the contrary, ACCA goes to the depths of accountancy and finance, in order to let you gain enough knowledge in the accounting field. |

| Starting level is from lower level in companies | ACCA's can attract more senior roles at managerial or director level which will attribute in accelerating their careers |

We assist students to secure high end jobs in the big fours (E&Y, PwC,

Delloite,

KPMG) and MNC’s. ACCA program opens up doors for diverse career

opportunities

like below:

Employability in India/Placement Services

ACCA has established mutual acknowledgment agreements with several key prestigious global accountancy bodies:

The Certified General Accountants Association of Canada The Hong Kong Institute of Certified Public Accountants The Malaysian Institute of Certified Public Accountants UAE– AAA (Accountants and Auditors Association) CA Australia and New Zealand

These agreements provide inexpensive routes for ACCA members to become a member of their bodies and appreciate the services that local organizations can offer.

The ACCA Exams are held 4 times in a year, generally in the first week of March June,September and December.

Exact date sheet is available at

https://www.accaglobal.com/in/en/student/exam-entry-and-administration.htmlACCA has 2 Approved Content Providers: BPP and Kaplan.

ACCA books are easily available online.

We do not provide the Books in the registration fees but we do assist the students in where to place the order from.

As part of your journey to become a qualified ACCA member, a candidate must demonstrate relevant skills and experience within a real work environment. This is what PER (Practical Experience Requirement) is all about. To complete PER, you will need to:

achieve 36 months of supervised experience in a relevant accounting or finance role(s)

complete nine performance objectives (five Essentials and four Technical)

record your progress online in MyExperience

have your experience signed off by a practical experience supervisor.